Why Selling Your Business to Your Employees May Make Sense

Multiple converging trends make Employee Stock Option Plans (ESOPs) an increasingly attractive exit option for business owners. From a demographic perspective, the wave of Baby Boomers exploring how to transition out of their businesses and into retirement continues. There’s also growing demand from employees who want a stake in their company’s success, as well as tax benefits for owners and employees alike.

“We’re looking at more and more companies taking this route versus other ways to sell, as they realize the tax and other advantages that ESOPs provide,” says Jason Muhme, Northwest Bank’s ESOP finance lead.

The National Center for Employee Ownership reports that there are roughly 6,500 ESOPs in the U.S. Muhme added that 350 to 400 new ESOPs were created last year, and he expects to see even more in 2024. For business owners who are planning for retirement or an exit, ESOPs provide some unique benefits that merit investigation — along with a few considerations.

The ESOP advantage

An ESOP is an employee benefit plan that enables employees to gain ownership of their company. Effectively, the business owner sells the company to a trust for the employees, and the employees earn shares as part of their workplace benefits. A company may fund an ESOP by putting cash into the trust or borrowing funds to make the transaction.

While the funding mechanisms and exact structure may vary, many business owners opt for ESOPs because they:

- Preserve the company’s legacy. Business owners may have spent years or even generations building their companies, establishing the company’s role in a community and cultivating loyal employees.

“ESOPs provide a way to maintain that legacy,” Muhme says. “The company continues on doing business as usual, the owners often stay in their current roles, and the employees are even more invested than they were before.”

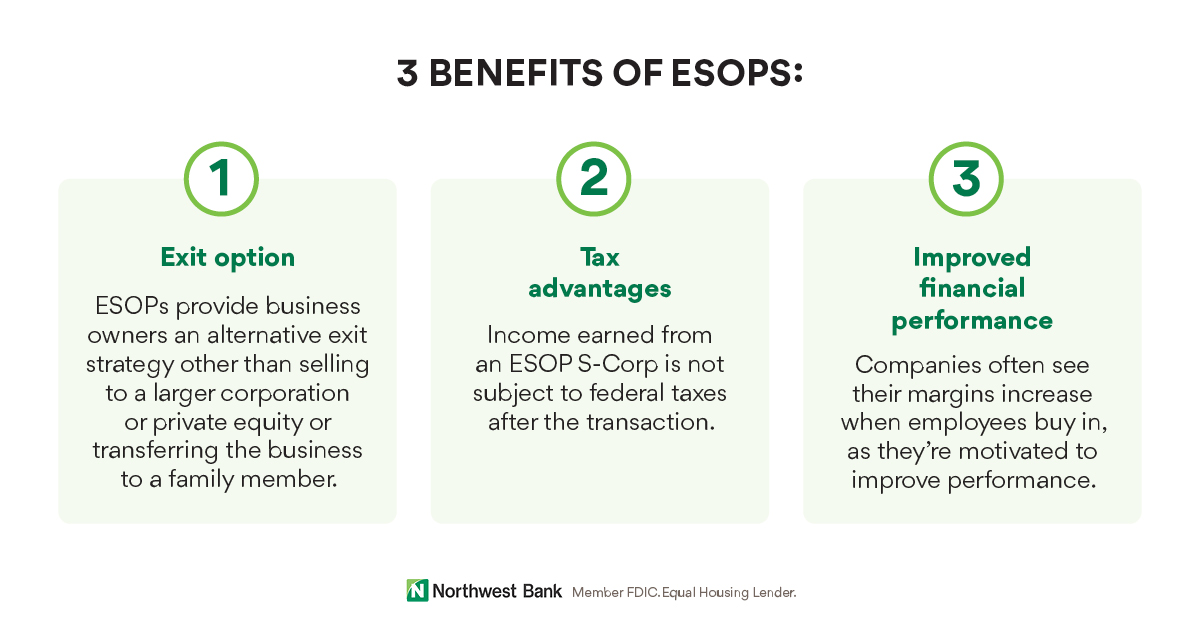

- Offer an alternative exit option. When it comes to exits, many business owners consider selling to a larger company, public equity or transferring the business to a family member. An ESOP provides another option, allowing business owners to access the company's value and allowing employees to benefit from its future success. Typically, the business owner receives the proceeds from the sale over the span of several years.

- Tap into tax advantages. ESOPs offer multiple tax benefits to the seller (business owner) and ESOP-owned corporations. Perhaps most appealing, the income earned from an ESOP S-Corp is not subject to federal taxes after the transaction.

In addition, the business owner treats the transaction as a stock sale and not an asset sale, meaning it is subject to the lower capital gains tax rate. If the company is a C-corp, they can also look at the 1042 election to defer the taxes. “The tax benefits are driving much of the interest in ESOPs,” Muhme adds.

- Improve employee retention and morale. In addition to the above, ESOPs often improve employee retention. Employees become genuinely invested in the company's future. Ownership can also boost morale, as employees feel more connected to the vision, mission and performance of the place where they work, as it’s now their business, too.

- Enhance financial performance. Lastly, Muhme notes that businesses that become ESOPs often experience improved financials. “Companies often see their margins increase when employees buy in,” he says.

The shared ownership creates a strong incentive for employees to sell more or do what they can to improve company performance. The same goes for being mindful of operating expenses.

Is an ESOP for you?

As with many business decisions, ESOPs also come with some considerations. For example, Muhme says ESOPs increase companies' reporting and administration requirements. Companies want to ensure their plans comply with Department of Labor, IRS and ERISA regulations. Third-party administration and expert financial advisors can help, but come with additional costs. “Still, you have the benefit of that tax-free growth, so the savings are still higher, even with the added costs,” Muhme says.

If your company is using debt to fund the ESOP transaction, taking on additional debt in the future may be more challenging. Muhme notes that it’s still possible, but if you aim to acquire another company or use debt to fund significant capital expenditures, you’ll need to do some strategic planning. “You may need to wait or not borrow as much as you originally anticipated,” he notes.

Even with these considerations, the upside of ESOPs continues to make them an attractive exit option for many business owners. If you want to learn more about how an ESOP could facilitate your business or retirement transition, connect with Northwest Bank today.